When Paul Krugman Started Authoring Babylon Bee Headlines

One evening recently, I was chatting with some buddies about going to see the Obituary/Cannibal Corpse show with Amon Amarth in May, when a friend tagged me on the latest column by New York Times columnist Paul Krugman.

It made me wonder what would be more punishing: listening to CC, or reading Mr. Krugman’s “Beware of Economists Who Won’t Admit They Were Wrong”?

In it, he calls out “the unwillingness of some influential economists and officials to accept the fact“ that “inflation came down amazingly fast at no visible cost.” They should admit “that they got it wrong.”

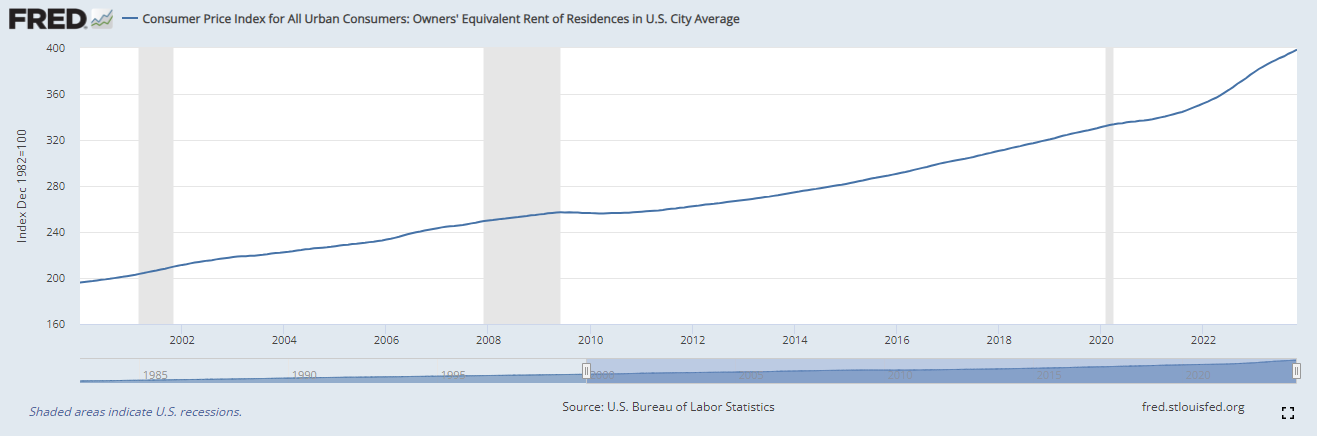

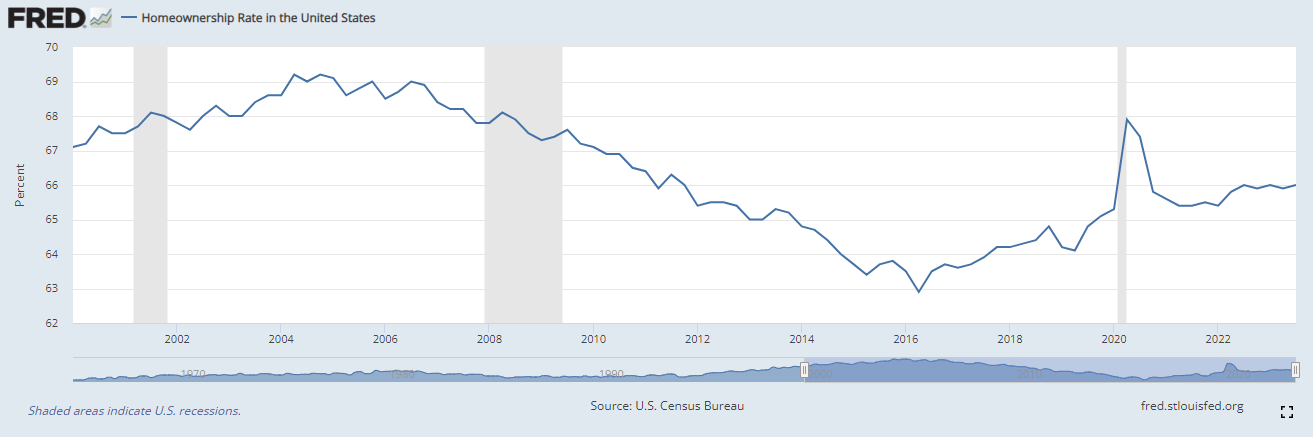

Not once in his piece however, does Mr. Krugman mention housing.

Regardless whether one rents or pays a mortgage, it’s a large and growing portion of a family’s budget. The more that line-item bulges, the less likely one is to buy. That’s a trend we’ve been seeing for much of this century thanks to a poor monetary regime.

The cynic would ask if housing has now been excluded from “core inflation.” That is the Federal Reserve’s “preferred” indicator on fluctuating prices. Like Mr. Krugman’s omission of housing prices, it also indicates the Fed’s disconnect from regular folks.

“Core” differs from the headline inflation rate in that it excludes food and energy prices, ostensibly due to their “volatility.” That’s rather convenient considering these biggest necessities of life are some of the most sensitive to a volatile currency.

It’s no coincidence that, even before the shutdowns, these three items’ prices were less stable than other goods and services we buy.

Unfortunately, to even begin to get that point across to government, establishment and media elites, we’d have to use their preferred pronouns for “shutdowns.” In Mr. Krugman’s case, that would be “covid disruptions.”

That makes the irony of the title of his column particularly choice.

He and his coterie don’t appear to have had the epiphany that the shutdowns were unnecessary at best, and haphazard at worst. The “supply chain issues” that contributed to exorbitant prices were merely “kinks” to be sorted out, in his telling.

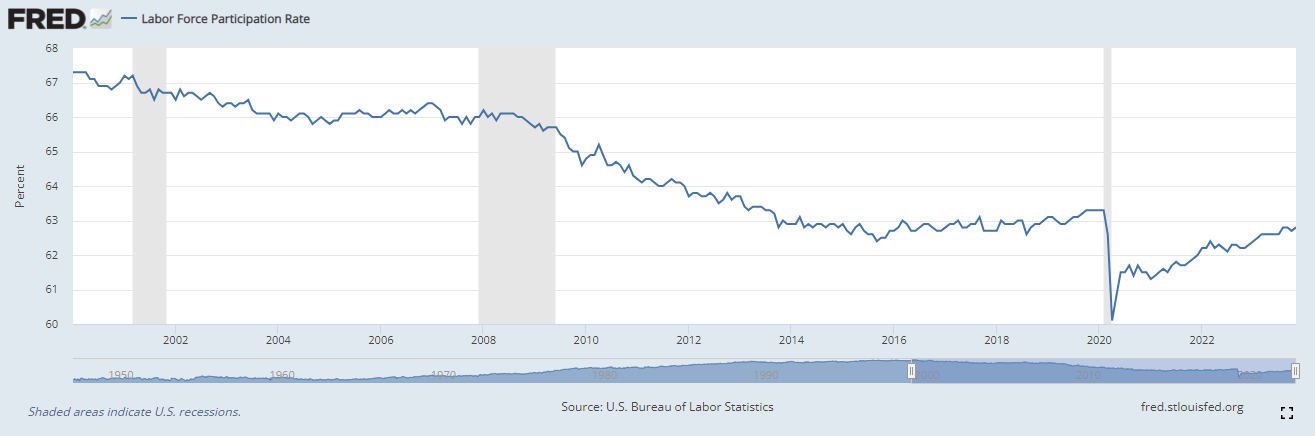

As if that’s not enough, there are other key measures that he ignores. One is the labor force participation rate (LFP).

One happy stat he cites is that the unemployment rate has remained under 4%. This runs contrary to the old way of thinking that, to fight inflation, unemployment must rise.

There are a few measures that I regularly tell my students must be coupled with other, equally important ones. Foreign direct investment balancing the widely-accepted, downbeat trade deficit is one. LFP is another.

It must be included in any serious discussion about the employment picture. A lower percentage of workers being jobless means little when fewer people are looking for work in the first place.

As of now, the LFP hasn’t fully recovered to pre-shutdown levels.

People are also facing rising insurance costs, property taxes, etc. Even concert ticket prices are a good deal higher than usual. Megadeth frontman Dave Mustaine is the latest to chime in on that.

Regardless, my buddies and I will probably find a way to that show in May. I think I’d rather have my senses assaulted by a death metal concert than a Nobel Laureate who doesn’t give the full picture of our current condition.

Free the People publishes opinion-based articles from contributing writers. The opinions and ideas expressed do not always reflect the opinions and ideas that Free the People endorses. We believe in free speech, and in providing a platform for open dialogue. Feel free to leave a comment.