This holiday season, American consumers have received an unexpected gift.

Mine came this morning when I filled up my car with gas. I paid $2.13 per gallon. This felt like luxury. It seems surprising, implausible, even wonderful. I asked around. Some people are paying even less, even $2. All the pressure is down. Down — despite everything.

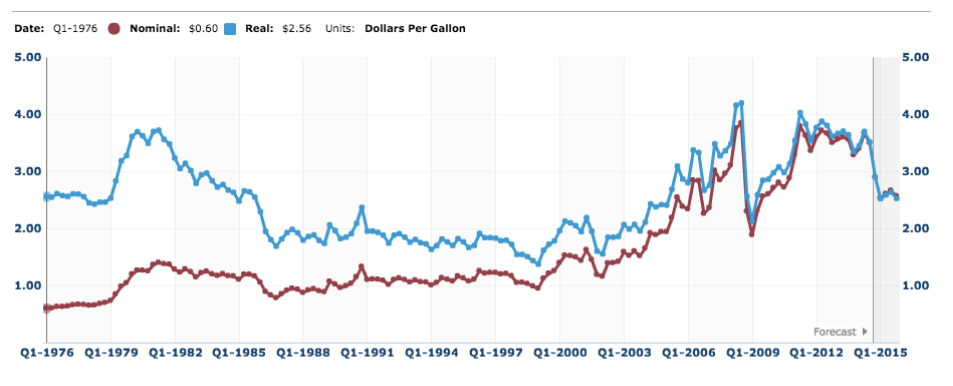

Looking at the history, I found the following chart from the U.S. Energy Administration, already a bit out of date — the forecast doesn’t anticipate the extent of the fall– but it shows that gas prices are settling back to 1990’s levels and lower today in real terms than they were 40 years ago. Have a look.

That’s just amazing. Why? If all you followed were the policies and the headlines, you would think prices would be ten times what they are. The low price comes about despite a vast and unrelenting barrage of policies and attempts to raise the price. And it was only some 10 years ago that “peak oil” theorists were explaining to use how oil was running out and prices were going to soar.

The gas price seems to have a mind of its own. People are notoriously ignorant about this fact. They imagine that there must be someone, some powerful cabal, behind the scenes that is setting it.

When prices rise during natural disasters, people assume that there is someone acting to take advantage of the situation by boosting the price. Gas-station owners are routinely hauled before legislatures to testify.

The populist opinion about this matter is cringe worthy, but so is a large part of educated opinion. The common knowledge many people think they know is unaware of the great truth about global market pricing. No one in particular is in control of it. It is formed by the countervailing forces of supply and demand and is set by the nonstop testing of millions and billions of consumption decisions, trades, and speculations. The price is the culmination of countless factors at work. It is evidence of an emergent not designed order.

If the market price were a person, he or she would be the wisest, most clever, most powerful person on the planet, causing the multitudes, even the ruling class with enough weaponry to destroy the planet, to submit and bow down in awe. The simple and unassuming price — so humble and yet so decisive for human decision making — is this concise point of data, a mere number, that actually causes nations to rise and fall, topples the mighty from their perches of power, and humbles the arrogant and pretentious with its truth-telling, rational, and yet unpredictable movements.

Those who want to rule the world fear the market price for this reason, but the rest of us experience it as a gentle force that grounds our daily life in reality in the midst of artificiality, pomp, and phoniness. The powerful can shake their fists at it, the codified intellectual class may curse it, and the ordained moralists can denounce it, but no one can make it obey the dictates of those who purport to stand above it, much less make it go away.

The market price is our salvation from the despotism of those who would rule us. The price of gas is a beautiful example. And who benefits in the end? You and I. All the activities of the market are ultimately directed toward pleasing the consumers.

Think for a moment of all powerful interests in the world that have pushed for higher gas prices and yet keep seeing their ambitions frustrated by a reality they despise.

The environmentalists are desperate for higher prices because they are against driving and internal combustion generally, which they believe causes terrible things to happen to the planet. They want us cycling around on bicycles as in Mao’s China or riding mass transit or slogging from place to place on foot. They’ve been hectoring us about this for decades. A high price for gas is the best way to bring about their dream to raise prices and discourage consumption. They cringe with every penny drop. “Fracking” is their F-bomb.

The oil industry itself is similarly happy with higher prices because that brings higher profits and funds more drilling, production, and exploration. When the oil industry was closest to the presidency, under the Bush years in the father and son presidencies, they worked to keep the prices and production high. Even war for oil became part of this strategy.

Some of the world’s richest and most powerful states, from Saudi Arabia to Russia to Iran to the United Arab Emirates, consider high oil prices to be their lifeblood. A U.S. gas price that is double or triple the current one could mint a slew of new billionaires.

And in the U.S., many states and localities depend on oil for the entire revenue stream. Politicians in places like Alaska, Texas, and Louisiana are actually freaking out about this price trend. If they could fix it, they would.

Then there are the urban planners — not to speak of legions of intellectuals — who want prices to soar to punish all us drivers and instead use their subways, buses, and taxi monopolies. That we keep insisting on sitting in our comfy seats and driving these machines around makes them all crazy. A low price of gas only encourages us to do more of what we love and what they hate.

It’s been a huge priority for government generally to subsidize alternative energies that don’t depend on fossil fuels. So long as gas remains affordable, alternative fuels will not get the boost that regulators want them to get.

Then there are the central bankers run by people who are somehow convinced that a falling price of gas is a bad omen of generalized deflationary trends. For five years, they’ve fought relentlessly against deflation, but there is a crucial thing they can’t control: the rate at which people themselves spend and borrow. That’s been the rub. It’s because consumers haven’t cooperated that the Fed has not achieved its aims.

For now, Janet Yellen is calming people down by saying she is not worried about the falling price of oil. In a press conference, she actually made some sense. “It’s something that is certainly good for families, for households,” she said. “It’s putting more money in their pockets, having to spend less on gas and energy, and so in that sense it’s like a tax cut that boosts their spending power.”

Then again, she is there to put a happy face on all things these days. Meanwhile, economists swirling in the Fed space are freaking out. They observe that recessions over the last 25 years have correlated closely with a falling oil price (and they thereby mix up cause and effect by looking at the data alone). “That 800 pound gorilla known as oil?… The Fed will have to address it. It needs to be proactive,” former Atlanta Fed director Dorothy Weaver told the Wall Street Journal.

But address it how? If boosting the monetary base by $3 trillion over 5 years couldn’t engineer a consumer-price inflation, it’s hard to imagine what tools the Fed has left to push the price of oil one direction or another.

In fact, if prices could truly be controlled by government and special interests, the gas price would be the model case. What we see is the opposite: the forces of globalization, production competition (cartels have been impossible to maintain), technological improvements like fracking, and the unstoppable invisible hand have prevailed.

Take comfort from the gasoline price. It is an indicator that the powerful aren’t really what they believe they are. Decentralized markets always in the long run outpace and outwit the ability of elites to manipulate them.

Makes me wish I had a car so I could go fill it up!

Makes me wish I had a car so I could go fill it up!

Even those of us who don’t drive (like me) can benefit and should be overjoyed by these recent developments.

Even those of us who don’t drive (like me) can benefit and should be overjoyed by these recent developments.

I’m anti-fracking and pro-environment, though not in the way you might suspect. I think that government-subsidized energy companies (of which oil is a big one) no longer has to answer to the public, only to the politicians signing off on subsidy bills. This is the prime causal factor behind oil spills and unsafe fracking operations- many of which have polluted groundwater to the extent that people can light their tap water on fire.

While it could be argued that gasoline is a necessity for daily life anymore, I don’t think this will always be the case. Exxon-Mobil, Shell, etc, will have to go green or become completely obsolescent.

To put it another way: the market for gasoline does not determine the price by itself. If more people are driving electric cars, are using bicycles, or going on foot, then less gas is being consumed. If people are buying houses used instead of having them built, then there’s no call for all that gas to be used up by construction vehicles.

This is one reason why control of the market is impossible. Government regulators, oil magnates, and central bankers can’t control the actions of individual people. That’s a very good thing because all the evidence I’ve seen points towards individual choice being the best corrective agent for an unfree, one-sided marketplace.

I’m anti-fracking and pro-environment, though not in the way you might suspect. I think that government-subsidized energy companies (of which oil is a big one) no longer has to answer to the public, only to the politicians signing off on subsidy bills. This is the prime causal factor behind oil spills and unsafe fracking operations- many of which have polluted groundwater to the extent that people can light their tap water on fire.

While it could be argued that gasoline is a necessity for daily life anymore, I don’t think this will always be the case. Exxon-Mobil, Shell, etc, will have to go green or become completely obsolescent.

To put it another way: the market for gasoline does not determine the price by itself. If more people are driving electric cars, are using bicycles, or going on foot, then less gas is being consumed. If people are buying houses used instead of having them built, then there’s no call for all that gas to be used up by construction vehicles.

This is one reason why control of the market is impossible. Government regulators, oil magnates, and central bankers can’t control the actions of individual people. That’s a very good thing because all the evidence I’ve seen points towards individual choice being the best corrective agent for an unfree, one-sided marketplace.

A beautiful description of the free market. Thank you.

I love it how when gas prices are high, the major parties blame each other. I’m sure now that they’re low they’ll both try to take credit (although the president usually has an edge in such discussions). Either way, it proves that they both have more faith in big government than the free market.

A beautiful description of the free market. Thank you.

I love it how when gas prices are high, the major parties blame each other. I’m sure now that they’re low they’ll both try to take credit (although the president usually has an edge in such discussions). Either way, it proves that they both have more faith in big government than the free market.

I paid $1.97/gallon in South Carolina today, driving from my folks in N.C. to my home in Georgia. The price in Georgia is still north of $2.00 but further south of $3.00, and I’m definitely not complaining. If the price remains so low throughout the new year, the drop might even pay for my increased health insurance premium post-Obamacare.

But the news can’t be good for everyone. For years, I’ve heard that the high price of oil powered a renaissance in energy production in the U.S., and only a few months ago, when the price fell below $80, I heard, “Don’t worry. The price must fall below $65 to threaten the boom.” Now, at $55/barrel, expanded production in the U.S. seems inconceivable, and U.S. production seems very likely to fall as the new, deep, thin wells here are depleted and can’t be replaced profitably.

According to Peter Schiff, David Stockman and others, the boom in U.S. production was a bubble fueled by cheap credit. Meanwhile, production outside of the U.S. hardly increased in the last decade even as the price tripled, so a peak in the production of less costly reserves still seems upon us.

Raise the price high enough, and more costly oil will be produced, but this fact doesn’t contradict Hubbert’s theory if the marginal cost of production also rises and remains high. At a high enough price, energy is practically unlimited, but credible theories of a peak in oil production take this fact for granted. Ever increasing production does not follow, because a rising price also depresses demand, and demand has fallen in the last decade.

Demand will rise at the lower price, but once markets have cleared at the lower price, if production of the less costly oil cannot rise commensurately, rising demand can only drive the price higher again, and the last decade hasn’t provided much evidence that production can rise without a rising price. If it can, why didn’t production of the less costly reserves outside of the U.S. rise when the price was higher?

Martin: you might want to check out the health sharing ministries. Theyre a way to avoid purchasing an obamacare policy and avoid the penalty tax. Theyre also surprisingly affordable and operate much moreso on market principles: you negotiate and pay cash for your medical care.

Part of the reason why some of the less costly reserves outside of the US aren’t rising is that a lot of them may be running at their current capacity. Look at a situation like Venezuela, where the effects of nationalization are hampering production efficiency. Nigeria, Lybia, Egypt, Iran, Angola all have various issues preventing them from having stable capacity.

I paid $1.97/gallon in South Carolina today, driving from my folks in N.C. to my home in Georgia. The price in Georgia is still north of $2.00 but further south of $3.00, and I’m definitely not complaining. If the price remains so low throughout the new year, the drop might even pay for my increased health insurance premium post-Obamacare.

But the news can’t be good for everyone. For years, I’ve heard that the high price of oil powered a renaissance in energy production in the U.S., and only a few months ago, when the price fell below $80, I heard, “Don’t worry. The price must fall below $65 to threaten the boom.” Now, at $55/barrel, expanded production in the U.S. seems inconceivable, and U.S. production seems very likely to fall as the new, deep, thin wells here are depleted and can’t be replaced profitably.

According to Peter Schiff, David Stockman and others, the boom in U.S. production was a bubble fueled by cheap credit. Meanwhile, production outside of the U.S. hardly increased in the last decade even as the price tripled, so a peak in the production of less costly reserves still seems upon us.

Raise the price high enough, and more costly oil will be produced, but this fact doesn’t contradict Hubbert’s theory if the marginal cost of production also rises and remains high. At a high enough price, energy is practically unlimited, but credible theories of a peak in oil production take this fact for granted. Ever increasing production does not follow, because a rising price also depresses demand, and demand has fallen in the last decade.

Demand will rise at the lower price, but once markets have cleared at the lower price, if production of the less costly oil cannot rise commensurately, rising demand can only drive the price higher again, and the last decade hasn’t provided much evidence that production can rise without a rising price. If it can, why didn’t production of the less costly reserves outside of the U.S. rise when the price was higher?

Martin: you might want to check out the health sharing ministries. Theyre a way to avoid purchasing an obamacare policy and avoid the penalty tax. Theyre also surprisingly affordable and operate much moreso on market principles: you negotiate and pay cash for your medical care.

Part of the reason why some of the less costly reserves outside of the US aren’t rising is that a lot of them may be running at their current capacity. Look at a situation like Venezuela, where the effects of nationalization are hampering production efficiency. Nigeria, Lybia, Egypt, Iran, Angola all have various issues preventing them from having stable capacity.

I don’t think this has much to do with the free market. I think the drop in gas prices has been orchestrated by the U.S. and Saudi governments to hurt Vladimir Putin’s regime.

Absolutely right on Matthew. why are people so blind and ignorant. There is nothing related to “the forces of globalization, production competition (cartels have been impossible to maintain), technological improvements like fracking”

I don’t think this has much to do with the free market. I think the drop in gas prices has been orchestrated by the U.S. and Saudi governments to hurt Vladimir Putin’s regime.

Absolutely right on Matthew. why are people so blind and ignorant. There is nothing related to “the forces of globalization, production competition (cartels have been impossible to maintain), technological improvements like fracking”

Fun article. I very much enjoyed it. One thing that would be interesting is to show how regulation has murdered one of the more practical and green alternatives for gasoline: CNG.

Fun article. I very much enjoyed it. One thing that would be interesting is to show how regulation has murdered one of the more practical and green alternatives for gasoline: CNG.

RE: The environmentalists are desperate for higher prices because they are against driving and internal combustion generally, which they believe causes terrible things to happen to the planet. They want us cycling around on bicycles as in Mao’s China or riding mass transit or slogging from place to place on foot. They’ve been hectoring us about this for decades. A high price for gas is the best way to bring about their dream to raise prices and discourage consumption. They cringe with every penny drop. “Fracking” is their F-bomb.

I’m glad you wrote “generally.” Haha.

As an unapologetic environmentalist, I can tell you that I am not “against” driving. I actually love road tripping. Although I do prefer using a fuel efficient vehicle because yes, the internal combustion engine is a machine that runs “dirty.” Does it destroy the planet? No. A “thing” can’t harm the environment. Only people can do that. As free-thinking individuals, we can choose how we want to get around. Whether by car, bus, train, bike or foot. I don’t “want” anyone doing anything they don’t want to do. And I would argue that there are plenty of other environmentalists who don’t preach and demand that folks get out of their cars and onto bikes. When we say things that identify environmentalists as these hostile types, all we do is further a divide that I believe shouldn’t even exist.

As far as wanting the price of gas to go higher, I just want it to represent the real cost of production, distribution and consumption. In the absence of subsidies (both direct and indirect) the price at the pump would be a lot higher than what we see now. I’d rather not be taxed at all and just pay a price that correlates to the real cost.

Just kind of ranting here. Sorry.

I suppose my point is that a.) There’s no free market when it comes to energy. There never has been, and until the government is removed entirely from the equation, there never will be. b.) There’s no greater advocate for the environment than a free-market thinker. We should not come across so hostile to environmental causes, as our own cause of liberty works in favor of the environment. I’ve spoken at many conferences and have been quite successful at convincing many of your left-leaning environmentalist types that personal responsibility and free markets benefit the health of the planet – not bureaucrats and superfluous regulations.

The cause for liberty and environmental sustainability are actually intertwined. It is in the absence of a real free market that we condemn ourselves to an unhealthy environment. Subsidies and special favors have provided a solid footing for all forms of transportation fuels and electricity generation. Not just alternatives. But all need to be completely dismantled in order for the market to dictate the most efficient and competitive options.

RE: The environmentalists are desperate for higher prices because they are against driving and internal combustion generally, which they believe causes terrible things to happen to the planet. They want us cycling around on bicycles as in Mao’s China or riding mass transit or slogging from place to place on foot. They’ve been hectoring us about this for decades. A high price for gas is the best way to bring about their dream to raise prices and discourage consumption. They cringe with every penny drop. “Fracking” is their F-bomb.

I’m glad you wrote “generally.” Haha.

As an unapologetic environmentalist, I can tell you that I am not “against” driving. I actually love road tripping. Although I do prefer using a fuel efficient vehicle because yes, the internal combustion engine is a machine that runs “dirty.” Does it destroy the planet? No. A “thing” can’t harm the environment. Only people can do that. As free-thinking individuals, we can choose how we want to get around. Whether by car, bus, train, bike or foot. I don’t “want” anyone doing anything they don’t want to do. And I would argue that there are plenty of other environmentalists who don’t preach and demand that folks get out of their cars and onto bikes. When we say things that identify environmentalists as these hostile types, all we do is further a divide that I believe shouldn’t even exist.

As far as wanting the price of gas to go higher, I just want it to represent the real cost of production, distribution and consumption. In the absence of subsidies (both direct and indirect) the price at the pump would be a lot higher than what we see now. I’d rather not be taxed at all and just pay a price that correlates to the real cost.

Just kind of ranting here. Sorry.

I suppose my point is that a.) There’s no free market when it comes to energy. There never has been, and until the government is removed entirely from the equation, there never will be. b.) There’s no greater advocate for the environment than a free-market thinker. We should not come across so hostile to environmental causes, as our own cause of liberty works in favor of the environment. I’ve spoken at many conferences and have been quite successful at convincing many of your left-leaning environmentalist types that personal responsibility and free markets benefit the health of the planet – not bureaucrats and superfluous regulations.

The cause for liberty and environmental sustainability are actually intertwined. It is in the absence of a real free market that we condemn ourselves to an unhealthy environment. Subsidies and special favors have provided a solid footing for all forms of transportation fuels and electricity generation. Not just alternatives. But all need to be completely dismantled in order for the market to dictate the most efficient and competitive options.

http://www.youtube.com/watch?v=CCJvi-zLEhQ

http://www.youtube.com/watch?v=CCJvi-zLEhQ

How exactly it was that Saudi Arabia would compensate the US for bombing the Assad infrastructure until the hated Syrian leader was toppled, creating a power vacuum in his wake that would allow Syria, Qatar, Jordan and/or Turkey to divide the spoils of war as they saw fit..

A glimpse of the answer was provided earlier in the article “The Oil Weapon: A New Way To Wage War”, because at the end of the day it is always about oil, and leverage..

The full answer comes courtesy of Anadolu Agency, which explains not only the big picture involving Saudi Arabia and its biggest asset, oil, but also the latest fracturing of OPEC at the behest of Saudi Arabia..

which however is merely using “the oil weapon” to target the old slash new Cold War foe #1: Vladimir Putin..

To wit:

Saudi Arabia will force the price of oil down, in an effort to put political pressure on Iran and Russia, according to the President of Saudi Arabia Oil Policies and Strategic Expectations Center..

Saudi Arabia plans to sell oil cheap for political reasons, one analyst says..

To pressure Iran to limit its nuclear program, and to change Russia’s position on Syria, Riyadh will sell oil below the average spot price at $50 to $60 per barrel in the Asian markets and North America, says Rashid Abanmy, President of the Riyadh-based Saudi Arabia Oil Policies and Strategic Expectations Center. The marked decrease in the price of oil in the last three months, to $92 from $115 per barrel, was caused by Saudi Arabia, according to Abanmy..

With oil demand declining, the ostensible reason for the price drop is to attract new clients, Abanmy said, but the real reason is political. Saudi Arabia wants to get Iran to limit its nuclear energy expansion, and to make Russia change its position of support for the Assad Regime in Syria. Both countries depend heavily on petroleum exports for revenue, and a lower oil price means less money coming in, Abanmy pointed out. The Gulf states will be less affected by the price drop, he added..

The Organization of the Petroleum Exporting Countries, which is the technical arbiter of the price of oil for Saudi Arabia and the 11 other countries that make up the group, won’t be able to affect Saudi Arabia’s decision, Abanmy maintained..

The organization’s decisions are only recommendations and are not binding for the member oil producing countries, he explained..

Today’s Brent closing price is around $85. Russia’s oil price budget for the period 2015-2017? $100..

Which means much more “forced Brent liquidation” is in the cards in the coming weeks as America’s suddenly once again very strategic ally, Saudi Arabia, does everything in its power to break Putin…

How exactly it was that Saudi Arabia would compensate the US for bombing the Assad infrastructure until the hated Syrian leader was toppled, creating a power vacuum in his wake that would allow Syria, Qatar, Jordan and/or Turkey to divide the spoils of war as they saw fit..

A glimpse of the answer was provided earlier in the article “The Oil Weapon: A New Way To Wage War”, because at the end of the day it is always about oil, and leverage..

The full answer comes courtesy of Anadolu Agency, which explains not only the big picture involving Saudi Arabia and its biggest asset, oil, but also the latest fracturing of OPEC at the behest of Saudi Arabia..

which however is merely using “the oil weapon” to target the old slash new Cold War foe #1: Vladimir Putin..

To wit:

Saudi Arabia will force the price of oil down, in an effort to put political pressure on Iran and Russia, according to the President of Saudi Arabia Oil Policies and Strategic Expectations Center..

Saudi Arabia plans to sell oil cheap for political reasons, one analyst says..

To pressure Iran to limit its nuclear program, and to change Russia’s position on Syria, Riyadh will sell oil below the average spot price at $50 to $60 per barrel in the Asian markets and North America, says Rashid Abanmy, President of the Riyadh-based Saudi Arabia Oil Policies and Strategic Expectations Center. The marked decrease in the price of oil in the last three months, to $92 from $115 per barrel, was caused by Saudi Arabia, according to Abanmy..

With oil demand declining, the ostensible reason for the price drop is to attract new clients, Abanmy said, but the real reason is political. Saudi Arabia wants to get Iran to limit its nuclear energy expansion, and to make Russia change its position of support for the Assad Regime in Syria. Both countries depend heavily on petroleum exports for revenue, and a lower oil price means less money coming in, Abanmy pointed out. The Gulf states will be less affected by the price drop, he added..

The Organization of the Petroleum Exporting Countries, which is the technical arbiter of the price of oil for Saudi Arabia and the 11 other countries that make up the group, won’t be able to affect Saudi Arabia’s decision, Abanmy maintained..

The organization’s decisions are only recommendations and are not binding for the member oil producing countries, he explained..

Today’s Brent closing price is around $85. Russia’s oil price budget for the period 2015-2017? $100..

Which means much more “forced Brent liquidation” is in the cards in the coming weeks as America’s suddenly once again very strategic ally, Saudi Arabia, does everything in its power to break Putin…