How a Millionaires’ Tax Would Only Make New York City More Expensive

Socialist Zohran Mamdani calls Capitalism theft. But his radical tax hikes will only hurt the middle class.

NYC Democratic Mayoral Candidate Zohran Mamdani has promised to make the Big Apple more affordable for lower income New Yorkers. How does the 33-year old, self-described democratic socialist plan to make life cheaper? Well, by taxing billionaires and making them “pay their fair share.”

There’s just one problem the billionaire-backed assemblyman doesn’t want you to know about: taxing NYC’s super rich will only push away much needed innovation and business, and lead to higher prices—and taxes—for everyone else.

Socialism’s Cure: Just Hike Up Taxes!

Socialists have long blamed the ultra rich for all of societal woes. From shoddy infrastructure, to low-quality public education, to crime spikes, millionaires and billionaires are the stereotypical scapegoats to justify increasing government regulation. Now, Mamdani is looking to get rid of billionaires altogether, and use a “millionaire’s tax” to fund his ambitious, yet highly unrealistic, social programs.

Mamdani has eagerly shared his views on wealth distribution: “I don’t think that we should have billionaires because, frankly, it is so much money in a moment of such inequality. And ultimately, what we need more of is equality across our city and across our state and across our country, and I look forward to working with everyone, including billionaires, to make a city that is fairer for all of them.”

While his “no cost” childcare program alone is estimated to cost anywhere between $5 to $8 billion a year, it is reasonable to say that Mamdani’s entire platform, from city-wide rent freezes, to government-run grocery stores and free transportation, could cost hundreds of millions—if not billions—in taxpayer dollars.

To match the costs, Mamdani is proposing to increase taxes on the city’s highest-income residents by slapping a flat 2% increase on New Yorkers earning $1 million or more each year. His campaign estimates this would generate $4 billion in incremental revenue. Mamdani also wants to raise the top corporate tax rate from 7.25% to 11.50%, which he claims would add $5 billion to the city’s coffers annually.

This sounds all well and good, but we shouldn’t believe for a second that NYC’s upper class would accept these pay cuts. If anything, they will repeat what they have done in the past: vote with their feet.

Overtaxing NYC’s rich will only come back to bite New Yorkers.

Apart from the fact that Mamdani has no legislative ability to enact these tax hikes himself—as all the power lies with Democrat Governor Kathy Hochul who has yet to pledge her support from the millennial socialist—NYC’s rich won’t go down without a fight, and will most likely flee for greener pastures while the middle-class is left to foot the bill.

New York has suffered a mass exodus of its millionaire residents since 2020. Billionaire hedge fund manager Bill Ackman remarked how Mamdani’s policies would be, “disastrous for NYC [and that] socialism has no place in the economic capital of our country.” This sentiment is shared by David Tepper, another hedge fund manager who, by transferring his residence from New Jersey to Florida, saved over $500 million in taxes. That’s revenue lost by the state, and money gained by business owners who move to more business-friendly states.

This phenomenon is seen nationwide. From 2016 and 2022, California experienced a “taxodus” of high-earning residents after the California Legislature passed Prop 55—a bill which extended California’s 13.3 percent tax rate (the highest in the nation) until 2030. The result? Millionaires left California in droves to states like Nevada, Texas, and Florida, leading to an estimated $1.7 billion loss in revenue. Today, California is still reeling from its $12 billion deficit, and is currently working to cut back on progressive policies and exuberant welfare programs to close in on its enormous debt. So much for “taxing the rich.”

Higher taxes are not only impractical, but inequitable too.

If Mamdani somehow succeeds in passing his extreme tax reforms, we are likely to see yet another exodus of New York’s wealthy elites. The only difference is, the middle and working class residents of NYC will be the ones left to pay for Mamdani’s billion-dollar social policies.

The uncomfortable truth is that wealthy Americans already pay the vast majority of taxes which directly fund these welfare initiatives. Research conducted by @Gieger_Capital presents a startling picture: while Americans who made over $500,000 a year brought in 23 percent of all income earned, they paid 54 percent of all income taxes collected in fiscal year 2024.

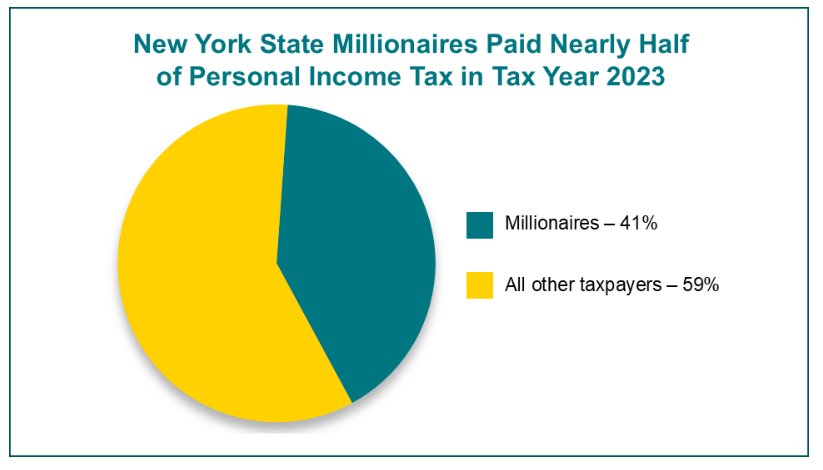

In New York specifically, residents who made at least $1 million a year (approximately 86,000 in total) only make up about 0.8 percent of tax filers, yet accounted for 41 percent of the total income taxes collected in fiscal year 2023. Meanwhile, the bottom half of New York taxpayers contributed less than 1 percent. Is Mamdani willing to accept up to a 41 percent cut in New York’s tax revenue by discriminating against his highest revenue producers?

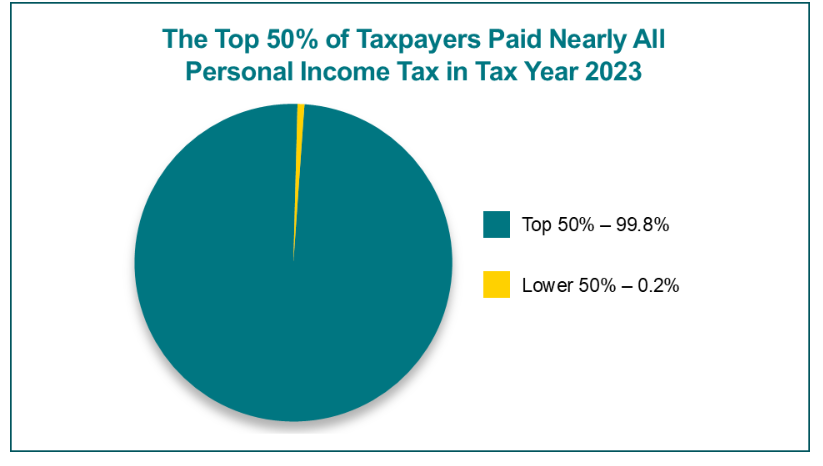

Unfortunately for the majority of New Yorkers, if the millionaires bail once again, they’ll be left with an expensive bill. The top 50 percent of New York taxpayers make up 99.8 percent of the state’s tax revenues. With the ultra-rich either gone or making use of coveted tax loopholes, New York’s middle class remains the backbone of the state’s budget. With ambitious social welfare programs potentially costing billions in taxpayer dollars, New York’s middle class will be obligated to pay for them and to absorb any tax increases which may follow.

Mamdani’s goal to provide government subsidized housing, food, and transport is starting to look like a proper socialist’s dream: promise to tax the rich while eventually forcing the middle class to foot the bill. When will they learn?

Free the People publishes opinion-based articles from contributing writers. The opinions and ideas expressed do not always reflect the opinions and ideas that Free the People endorses. We believe in free speech, and in providing a platform for open dialogue. Feel free to leave a comment.