Why Tax When They Can Just Print?

Why do they tax when they can just print it all?

Ask Modern Monetary Theory (MMT) inflationists, and they’ll say we tax to punish the bad people who have too much money.

Ask most economics professors—who lean left—and they’ll say taxes lower inflation since they drain private spending so it doesn’t compete with government spending.

But the real reason why you shouldn’t print is that inflation destroys even more than taxes.

The Inflation Tax

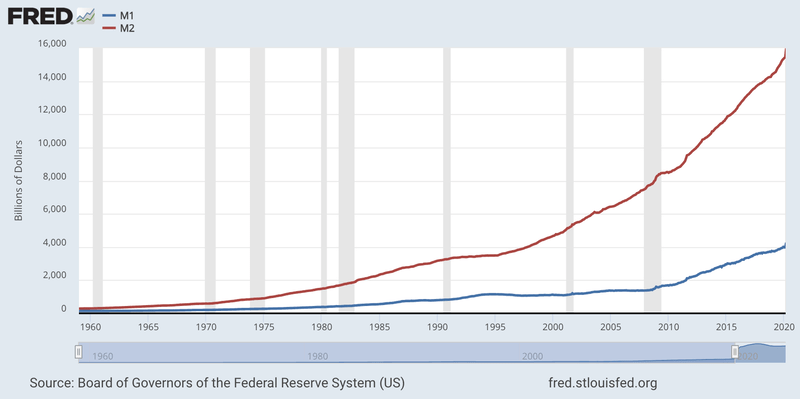

The past 5 years showed us the catastrophe of unbridled money-printing. But even in normal times the Fed prints up an awful lot of money. In the 5 years before 2019 the Fed printed up, directly and indirectly, about $800 billion per year—that’s annual change in M2.

About a quarter of that is direct—the Fed buys federal debt, lending money to the treasury. The other three-quarters—about 600 billion—is created by commercial banks, who magic up the money they lend to you.

We can proxy this commercial bank money-printing with M2—a wider measure of money that captures that lending.

Now, studies have shown that a dollar in inflation destroys about a dollar in GDP via reduced incentives to build and work.

This beats taxes, which destroy 2-3 dollars per dollar collected.

But spot the problem—printing 800 billion only raised 200 for Treasury. The rest was gobbled up by Wall Street loans.

That means to raise a given revenue from inflation you’d need 4 times as much inflation. So you’d destroy not 1 dollar but 4 dollars.

What if Treasury Printed it All?

Of course, it doesn’t have to be this way: you could cut off Wall Street by raising reserve ratios, putting limits on bailouts, or ending fractional reserve.

Alas, you go to war with the system you have. Meaning that 4 to 1 ratio is here for now.

Still, what if we did it differently? What if Treasury just printed all 800 billion. After all, that would fully replace a third of income taxes. Toss in Trump’s tariffs and you’re close to abolishing the income tax.

In that case, in terms of GDP, you would be better off with inflation than tax.

Thing is, GDP’s only half the story. The other half is wealth.

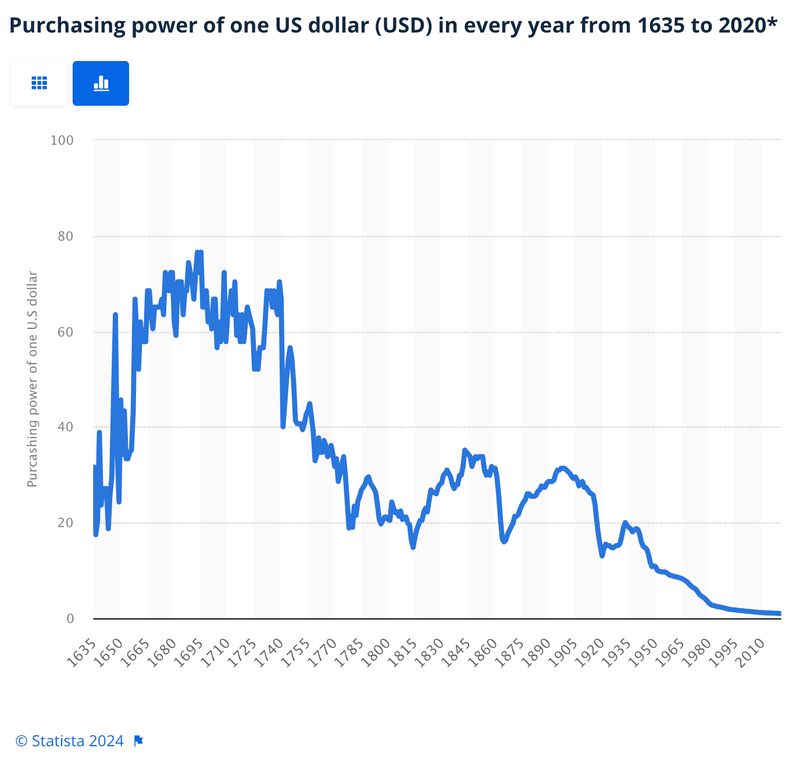

Inflation doesn’t just sap incentives, it dilutes all existing dollars—water into the wine of your life savings.

To illustrate, Americans own about 31 trillion in bank deposits and bonds—a bond is essentially a dollar with an interest rate. Along with 3 trillion in pensions that aren’t adjusted for inflation. Set against 13 trillion in mortgages where you actually make money when inflation goes up—your mortgage melts away.

That nets to 21 trillion in dollar exposure for Americans.

Meaning a 1% rise in inflation destroys 1% of that—$210 billion in wealth.

Add that to the one dollar GDP hit and you’re costing about 2 dollars in output and wealth for every dollar printed. Multiply by 4 for Wall Street’s cut and it’s 8 dollars.

Compared to 2 to 3 for taxes.

So, yes, you can replace taxes with printing. But you’ll destroy even more. And so long as Wall Street’s getting its three-quarters share you’ll destroy a lot more.

What’s Next

Whether the government taxes or inflates, the common thread it destroys much more than it takes.

Toss in the stupid crap it blew the money on—I mentioned in a previous video how a dollar in bureaucrat salary destroys $158 in production. It adds up fast.

If the federal government’s going to print money the proceeds should go to the people. But, ideally, it prints nothing, backs the dollar with hard assets, and taxes as close to nothing as possible.

This article was originally published on MoneyMetals.com.

Free the People publishes opinion-based articles from contributing writers. The opinions and ideas expressed do not always reflect the opinions and ideas that Free the People endorses. We believe in free speech, and in providing a platform for open dialogue. Feel free to leave a comment.