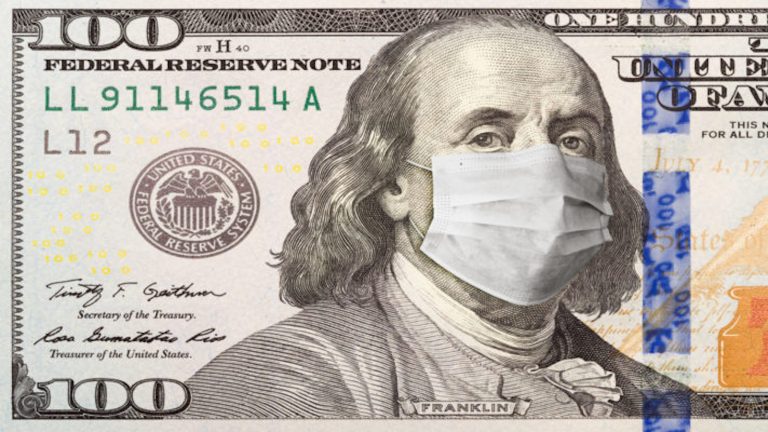

The Senate passed the largest stimulus bill in U.S. history at $2 trillion, to soon raise the national debt from its current $23 trillion—a virtually unfathomable amount of money.

To give some perspective to this national crisis, if we were to pile our debt into single dollar bills on top of one another, we could create six stacks reaching the moon and six more stacks encircling the circumference of the Earth. The U.S. government’s spending is frankly out of this world.

Woefully, this unprecedented expenditure is of recent creation. Since September of 2009, our national debt has increased from $13.5 trillion to $23.6 trillion. Throughout this country’s 244-year duration, we have managed to nearly double the debt in a single decade.

Regarding this issue, there can be no pointing the finger at the other side of the political aisle. This debt was created by both Republican and Democrat partisan hacks with each succeeding president outspending his predecessor, and every member of Congress assuring handouts for their re-election.

So, what are some of the underlying problems fueling this crisis?

There is a trending economic idea evidently held by many politicians and promoted by the economist Paul Krugman which has laid a strong foundation for a growing statism. Essentially, Krugman argues that the United States should not be concerned over the debt because “we owe it to ourselves.”

This idea is patently false and incredibly destructive. As many economists have noted, its biggest flaw is that it conflates private debt with public debt.

The national debt is not an accumulation of the debt of individual citizens; it is the mismanagement of tax dollars from politicians and bureaucrats in our federal government. Besides, how can Krugman define “we” as both the debtor and the creditor? He is denying the literal meaning of debt. The suggestion that there is only one party involved in the scenario is simply a rejection of reality and a fallacious misunderstanding of the terms “we” and “ourselves”.

Regardless of erroneous economic theories, anytime the government spends money in place of private businesses, it prevents the natural transactions that would occur had the government not intervened.

This phenomenon is known as crowding out and is a negative effect of nearly all government spending. If the economy is ever in a down period, you can be certain that the government will step in to squander money and prevent opportunity for the free market.

In the current stimulus package, the government has gone so far as to directly pay $1200 to every American earning up to $75,000. (For reference to the number of people included in this distribution, the U.S. median household income in 2018 was $63,179.)

Ask yourself, will there ever be a period of hardship where the government will not interject itself? Are there any situations or circumstances that will not create justifications for government intervention?

This is not to downplay the seriousness of our current situation. Our physical well-being and means of income are both extremely important; and unfortunately, there are many that have been seriously affected by this crisis in one or both of these categories. More than 1000 Americans have died from the coronavirus and according to The New York Times, 3.2 million people filed for unemployment just last week.

But when we live in such a complex and interdependent society relying on the division of labor and freedom to exchange goods, are cash handouts the appropriate and effective remedy to this issue?

There is always an excuse for government intervention and a fabricated reason to doubt in the free market. This recurring cycle is not what is so concerning. What is truly concerning is the hastiness we the people now have to rely on big government to bail us out of every difficult situation we find ourselves in.

It seems we have forgotten the wise words of President Reagan: “Government is not the solution to our problem; government is the problem.”

A national debt entirely created by a negligent and irresponsible government body is clear evidence of this. Yet, we willingly put ourselves into deeper debt by misunderstanding our economic condition, doubting the free market system, and electing short-sighted selfish politicians.

Nevertheless, politicians and news outlets will tout this stimulus bill as the long-awaited solution and victory for our country. The question remains: At what cost did we achieve this victory?

Add comment